ezPayCheck

2024 (3.14.12)ezPayCheck: A finance utility that can be of assistance to small business managers who want to save money by calculating and reporting taxes and deductions on their own

Accurately calculating and managing taxes and paychecks requires proper knowledge that only a professional accountant has. Smaller companies that don't want to pay for the services of such a specialist can use a payroll application such as ezPayCheck to handle their financial data.With the help of this application, small business managers can perform tax-related tasks on their own, without resorting to experts. The application is easy to handle and the intuitive GUI offers one-click access to all the options, making it possible for beginners to use it without facing difficulties.

You can enter detailed data about your company within the designated section, as well as information regarding the federal and state payroll taxes. Based on the data you provided, the application can give you a helping hand in determining health insurance and other deductions, configuring regular and non-regular wages and printing all sorts of forms and reports.

The built-in wizards make tasks even more easy to perform. You can use them to manage the employee database, which comprises data about the salary (regular rates and payments, retirement plans and deductions, tips, commissions and customized wages), together with contact information and tax-related details.

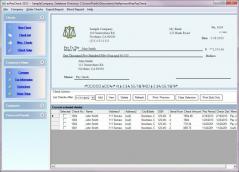

In order to generate a paycheck, your only task is to complete some required fields for the selected employee, namely the valability time interval, as well as income, deductions and taxes and banking data. The check value is instantly calculated and a preview is displayed within the main window, alongside options to print the form.

The application can be used for generating multiple types of forms (W-2, W-3, 941 and 940, Quarterly Federal Tax Return etc.) and reports that you must send to the financial authority.

ezPayCheck is versatile enough to meet the specific needs of both regular companies and non-profit organizations. The intuitive GUI layout and the forthright options make tax management and report an easy task.

Download Details

-

License:

Trial ($149)

-

Platform:

Windows

- Publisher:

-

File size:

6.50 Mb

-

Updated:

Jun 07, 2024

-

User Rating:

0 / 5 (0 votes)

-

Editors' Review:

Not yet reviewed

-

Downloads:

2,128

Similar software

Payroll Mate 2020 16.0.46

A useful application that calculates payroll taxes, prints checks and generates reports in a feature-rich yet, friendly interface

20 / 1,403

Netpas Distance 4.1 Build 4144

A powerful software solution that allows you to create tracking vessels and routes

57 / 4,059

HomeBank 5.8.1

A free personal finance application for managing and tracking your expenses, accounts and payees

43 / 1,936