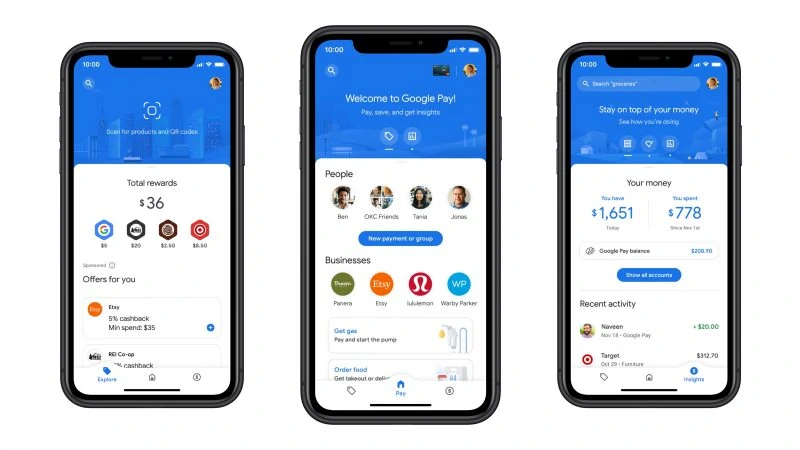

Google has recently re-launched Google Pay, its very own digital wallet platform and online payment system.

Digital wallets and mobile or online payments have been recently in demand as it requires less contact and less hassle, making transactions quite fast. What gives Google Pay the edge among other online payments platform is the fact that is powered by Google. Hence, all apps that require payments signed in with your Google account can be integrated with this feature.

The app can be used to make payments on-the-go or even be your personal banking solution.

Here are some efficient ways on how you can use the Google Pay app

Mobile Payments

Primarily, Google Pay was launched for Mobile Payments hence this is still one of the apps key features. You can add your credit or debit cards as well as your loyalty cards and use the app to pay by tapping your phone into contactless readers. You don’t need to open the app. Google Pay will only require you to unlock your phone and tap it to the reader.

The availability of readers will depend on the merchant or store you’re buying from. But in general, this makes in-store payments much easier.

Your registered cards can also serve as payment methods for other areas on your Google Play. The app features a section for ordering food from various restaurants as well as a section for paying for gas stations. You can easily find these options on the app’s Pay tab.

Google Pay also allows you to pay for Google products and services. Meanwhile, for purchases from another app or website, you can look for the Buy with GPay or GPay button. If you see one, then you can use your Google Pay account to choose a card and make a payment.

Similar: Disable Apple Pay side button access on your iPhone X

Peer-to-Peer or Group Payments

Another feature that is highly notable from the Google Pay app is that it allows you to send money to friends or create a group for splitting expenses. You can do this among friends who are also Google Pay users.

The platform presents the payments both for one-on-one and group payments in a chatroom-ish UI. With this, sending money just simply seems like you’re sending a text message or a chat.

It also helps you easily monitor payments for shared expenses among groups. For example, you have to split a bill on a restaurant or for the rent, you can keep track of who has paid and who has not through the app. You can even send reminders or messages to them too.

Pretty handy for keeping friendships strong, right?

Personal Finance Management

Google Play has a specified tab for Insights which provides an overview of your expenses. This feature can also help monitor all the transactions on your credit or debit cards. It

Generally, the Insights Tab can be just like a personal finance app. It provides reports on your spending habits and keeps track of your previous, as well as your future expense too, like bills and other payables.

As the app is a product of Google, it can also scan your Gmail and Google photos to look for receipts and bills. It will gather necessary financial information for you, collating it in a single platform for easier management. The app will only do this if you give permission and you trust Google enough.

For Finding Deals & Discounts

If you are an avid shopper or you just like to save some from your purchase, the Explore tab is something that you should not miss. This tab is dedicated to finding great deals for your next purchases.

It displays general promos but if you want to see personalized deals, you can allow Google Pay to scan through your transaction history and analyze what deals suit you.

Other than the discounts, you can also see cashback offers on the app. The money that you can get back from purchases will be added directly to your Google Pay account.

To avail of the promos you like, just tap the corresponding Activate button for it then choose a debit or credit card you want to use for the transaction. Afterward, you can go ahead and shop seamlessly while saving.

Other than the offers listed on the app, the Explore tab also features a QR code and barcode scanner. With this, you can scan products while you’re at the store and let the app find the best deal for it via Google Shopping.

Is Google Pay Safe to Use?

Financial information is highly sensitive and Google is well aware of that. Privacy and securing data is always a major concern for Google products.

Hence, it is good to take note that most of their features are opt-in. This means it will only be activated and your data will only be gathered upon giving the app the permissions.

With its built-in authentication, transaction encryption, and fraud protection, Google guarantees that using the Google Pay app is safer than physically swiping cards. They also note that they will not sell personal information to third parties or share transaction history with any other Google service for targeting ads.

After all, Google Pay still gives its users control over their money, financial information, and the payment methods they want to use, so you can still secure your data yourself.

In the digital world, there are always concerns when it comes to Privacy and Security. The loopholes seem endless but Google, as a tech giant, is always out to find better ways to ensure people that their data is safe.

What’s next for Google Pay?

By 2021, Google is even planning to partner with established financial institutions to fully integrate online savings and checking accounts into the Google Pay app. It will be launched as Google Plex.

The service will be similar to that of the Apple Card. Google will be partnering with banks and credit unions for storing and processing money while allowing people to manage their accounts via Google Pay.

The newly updated Google Pay app is quite an impressive all-in-one platform for managing finances, payments, transferring or sending money, and getting rewards and discounts.

It might be a bold step for Google, but it seems that it can come after payment platforms like Paypal and Apple Pay. It can be really worth a try and, it is good to note that there is so much more to look forward to it.

![[Guide] Enable the hidden ‘Condensed’ display mode on Samsung Galaxy S7 and S6 Enable the hidden 'Condensed' display mode on Samsung Galaxy S7](https://www.bytesin.com/wp-content/uploads/2016/04/Activate-the-hidden-Condensed-display-mode-on-Samsung-Galaxy-S7-120x70.webp)